Investment and Financing Models for PCR Innovation Market - Key Drivers, Disruption Signals & Industry Scenarios

Investment and Financing Models for PCR Innovation Market Size and Share Forecast Outlook 2026 to 2036

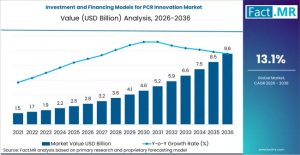

ROCKVILLE, MD, UNITED STATES, January 23, 2026 /EINPresswire.com/ -- The Investment and Financing Models for PCR Innovation Market is projected to expand significantly over the next decade as corporations, investors, governments, and financial institutions increasingly deploy capital toward innovations in post‑consumer recycled (PCR) materials, recycling technologies, and circular value chains. With heightened environmental, social, and governance (ESG) commitments, regulatory pressure for recycled content, and emerging business models that unlock value from circular material streams, the market is expected to grow from an estimated USD 1.15 billion in 2026 to approximately USD 4.2 billion by 2036, reflecting a compound annual growth rate (CAGR) of about 14.5% over the forecast period.This growth underscores the importance of innovative financing structures and investment vehicles that enable scalable solutions in PCR feedstock sourcing, material processing, certification, traceability, and application across industries.

Request for Sample Report | Customize Report | Purchase Full Report – https://www.factmr.com/connectus/sample?flag=S&rep_id=13824

Market Overview:

Who is driving the market?

The market is driven by a diverse set of stakeholders, including institutional investors, venture capital and private equity firms, corporate sustainability investment arms, government grant and incentive programs, impact investors, recyclers, material innovators, and brand owners seeking to meet recycled content targets. Financial intermediaries, sustainable finance platforms, and development banks also play a key role in structuring capital for PCR innovation.

What is the Investment and Financing Models for PCR Innovation Market?

This market comprises capital formation mechanisms, financing instruments, and investment strategies that support the development and commercialization of PCR materials, recycling infrastructure, circular supply chain technologies, and end‑use applications. Models include equity and debt funding, blended finance, grants and subsidies, green bonds, revenue‑based financing, public‑private partnerships, tax incentives, and impact investment funds that specifically target environmental innovation and circular material adoption.

When is the market expected to grow?

The market is expected to grow robustly through the 2026–2036 period as demand for recycled materials and circular business models increases globally and sustainability investments become mainstream in corporate and institutional portfolios.

Where is the market expanding?

Growth is global, driven by activity in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe and North America lead in institutional commitments to sustainability and recycled content mandates, while Asia Pacific is emerging rapidly due to industrial growth, urbanization, and policy emphasis on circular economy strategies.

Why is the market growing?

Several key trends are driving market expansion:

Increasing regulatory and voluntary recycled content requirements

Corporate ESG and net‑zero commitments that integrate recycled material innovation

Expansion of sustainable finance instruments such as green bonds and impact funds

Growth in circular supply chains and demand for credible material traceability and certification

Rising awareness that PCR innovation can reduce carbon footprint, waste, and dependency on virgin materials

How is the market evolving?

The market is evolving through the creation of specialized investment funds, blended finance structures, and collaborative financing platforms that align public policy goals with private capital. Financial models emphasize risk sharing, performance incentives, and measurable environmental outcomes, enabling investors and innovators to scale PCR technologies with commercial and sustainability performance metrics.

Market Context: Key Trends and Segment Insights

Blended and Impact Financing

Blended finance — combining public, private, and philanthropic capital — is gaining traction as a way to de‑risk early‑stage PCR technology investments and attract institutional participation. Impact investment vehicles focus on measurable environmental benefits alongside financial returns.

Green Bonds and Sustainable Debt

Sustainable debt instruments, including green bonds and sustainability‑linked loans, are increasingly used to finance large‑scale recycling infrastructure, PCR material facilities, and certification and traceability systems that support recycled content verification.

Public‑Private Partnerships and Incentives

Government incentives, tax credits, and public funding programs are aligning with private investment to accelerate PCR innovation deployment, stimulate recycling value chain development, and enable broader adoption of recycled materials across sectors.

Corporate Venture and Strategic Investment

Brands and manufacturers with sustainability goals are increasingly establishing corporate venture arms or strategic investment vehicles to fund startups and technologies focused on PCR materials, traceability platforms, and end‑use application innovation.

Regional Growth Dynamics

Europe: Leading adoption supported by comprehensive recycled content regulations, extended producer responsibility (EPR) frameworks, and advanced sustainable finance ecosystems.

North America: Strong growth driven by corporate ESG commitments, venture capital interest in circular technologies, and expanding impact investment markets.

Asia Pacific: Rapid expansion as emerging economies adopt circular economy policies, industrialize recycling infrastructure, and attract sustainable capital.

Latin America and Middle East & Africa: Emerging growth influenced by rising sustainability interest, government policy alignment, and cross‑border investment integration.

Competitive Landscape

The competitive landscape includes investment firms, venture capital funds, private equity investors, sustainable finance platforms, development banks, and technology incubators that focus on circular economy and recycled material innovation. Differentiation is based on capital deployment expertise, risk management frameworks, environmental impact measurement, deal sourcing networks, and ability to structure blended finance arrangements that meet investor and sustainability criteria.

Outlook for Industry Stakeholders

The Investment and Financing Models for PCR Innovation Market offers significant opportunities for financial institutions, technology developers, material suppliers, and corporate sustainability leaders. As recycled content expectations and circular economy strategies continue to strengthen globally, demand for innovative investment and financing solutions that catalyze PCR material adoption and recycling technology deployment is expected to rise sharply through 2036. Continued development of sustainable finance instruments, performance‑linked funding models, and collaborative investment networks will be essential to unlocking long‑term market potential and supporting global sustainability objectives.

Browse Full Report : https://www.factmr.com/report/pcr-packaging-for-pharma-and-otc-market

To View Related Report :

NAND Flash Market: https://www.factmr.com/report/nand-flash-market

Landscape Lighting Market: https://www.factmr.com/report/2856/landscape-lighting-market

Handheld RFID Readers Market: https://www.factmr.com/report/2845/handheld-rfid-readers-market

Standalone Trackpad Market: https://www.factmr.com/report/standalone-trackpad-market

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.